Firm on trade-centric business and searching for new business to drive the next 100 years

Trading is Hyundai Corporation’s core business. Over 90% of sales come from trading, which is higher than other trading companies. Amidst the diversification movement of general trading companies, HC has been increasing its competitiveness by concentrating on its traditional trading business and will continue to focus on cash cow trading as its core business in the future.

However, the company will continue to explore new businesses to drive growth over the next 100 years. That is why the company changed its name from ‘Hyundai Sangsa’ to ‘Hyundai Corporation’ in 2021 and why Chairman Chung Mong-hyuk emphasized the importance of buyout deals at its Global Strategy Conference for the second consecutive year. Hyundai Corporation is now seeking equity investments in companies that deal with automobile parts, transformers, and more.

■ Trading share stays high; eyeing ‘auto parts’ sector’

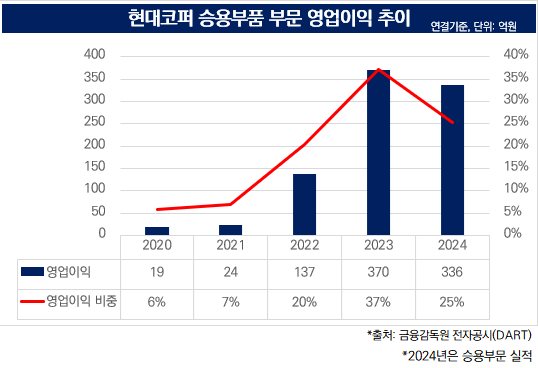

Hyundai Corporation’s Operating Profit and Operating Profit Margin Trend

Hyundai Corporation’s Operating Profit and Operating Profit Margin Trend

for Automobile Parts(Consolidated Basis, Unit: Billion KRW)

* Source: Data Analysis, Retrieval, and Transfer System (DART) of the Financial Supervisory Service

(2024 indicates automobile division results)

현Trading is Hyundai Corporation’s core business. More than 90% of its sales come from trading, making it highly dependent on it. Its products include steel, passenger vehicles, automobile parts, ships, and EPC equipment. It was founded in 1976 and was the general trading company of the Hyundai family group before being spun off from Hyundai Heavy Industries in 2016.

Like many other trading companies, HC has been involved in overseas resource development. The Yemen LNG project in 1998 is a notable example. It secured a 5.9% stake in the gas field through its subsidiary Hyundai Yemen LNG. This had been profitable since 2012, and the company had generated around KRW 50 billion in dividend income from the Yemen LNG project. However, production was halted in 2015 when the Yemeni civil war broke out, and it is still unclear when the project will resume.

While trading remains its core business, HC continues to diversify its portfolio. One example is its automobile parts business. In 2021, HC amended its business purpose to include the manufacture and sale of automobiles and automobile parts. Since then, the company has established auto parts-related factories in Russia and Indonesia.

Over the past five years, the profitability of the passenger vehicle parts business, which includes auto parts, has started to increase. Its share of total operating profit is also increasing, with last year’s profit reaching 37%. However, the division shifted from passenger vehicle parts to energy-related commercial parts in the same year.

The company is currently pursuing equity investments in auto parts companies. It is once again trying to acquire Sinki Intermobile, after its previous acquisition attempt was canceled in 2021. Also, on the 4th of this month, HC announced that it has signed an MOU to acquire a stake in a domestic auto parts company. As a result, the company is expanding its business through such companies.

■ Reaffirming commitment to new business, with focus on photovoltaic recycling and transformers

Hyundai Corporation’s move for equity acquisition was backed by a group-wide commitment. For two consecutive years, Chairman Chung Mong-hyuk has emphasized the need for new businesses at the company’s Global Strategy Conference (GSC). His message was that closing buyout deals is a top priority for growth.

The “3H” strategy outlines Hyundai Corporation’s vision. “H1” represents the existing trading business that serves as a cash cow. “H2” refers to upstream and downstream businesses related to trading, and “H3” encompasses entirely new ventures unrelated to the existing business. This means that the company will continue to advance its trading business, its foundation, while recognizing the need to expand into H2 and H3 sectors to prepare for the next 100 years. Buyout deals are a key method for driving this expansion.

Hyundai Corporation is actively expanding its business through equity acquisitions. Last year, it invested in the German PV recycling company Flaxres. It is also reportedly looking at smaller companies that deal with auto parts, transformers, etc. The goal is to identify companies that possess the technology but lack sales or funding, with the aim of growing together in global markets.

“The fact that Korea needs to make a living from exports has not changed, so we will continue to view trading as our core business,” said a Hyundai Corporation official. “We have the will to expand new businesses for sustainable growth, and our goal is to invest in small- and medium-sized enterprises and strengthen their fundamentals.”

April 18, 2025

The Bell