Established ‘Hyundai Re-Earth’ with Flaxres

Speeding up new business in an eco-friendly sector

Increased demand for aging module replacement in the US and Europe

Market value to reach KRW 680 billion next year alone

Overseas market search will be followed by domestic demonstration

Hyundai Corporation (HC), the general trading company representing the Hyundai family group, established a photovoltaic (PV) recycling joint venture with a German PV recycling company, Flaxres. The joint venture will speed up the development of new eco-friendly businesses in the diversification movement. HC will soon conduct a domestic demonstration of the PV recycling business and expand its scope overseas, with the market predicting that HC will surpass KRW 7 trillion in sales for the first time this year.

■ Establishes the first recycling JV, ‘Hyundai Re-Earth’

According to Financial News, HC established a joint venture (JV) with Flaxres on the 29th of last month, called ‘Hyundai Re-Earth Inc.’ The name is a combination of the words “Re-” and “Earth,” emphasizing that it is a recycling company. It is located in Jongno, Seoul.

This is the first time the company has established a JV in recycling sector. The exact shareholding structure is unknown, but it is understood that HC has taken a majority stake. Flaxres is the company Hyundai acquired a partial stake in through an investment last year. The initial in-house directors are PV Recycle Leader Kang Dong-Uk and Executive Director Choi In-Beom, who were instrumental in the company’s equity investment. PV Recycle Leader Kang, who has been with HC since 2007, became involved in the business around five years ago. Hyundai Re-Earth plans to conduct a wide range of businesses, including wholesale and retail, new and renewable energy-related businesses, software consulting, and development and supply. In addition, the company will manufacture, sell, and maintain waste-to-energy facilities.

The previous acquisition of a partial stake in Flaxres was aimed at acquiring its solar panel recycling technology. Flaxres possesses technology that separates solar panel waste by applying high heat for a short period of time. Compared to the current physical shredding and pyrolysis methods, Flaxres’ technology has great advantages in terms of recycling speed, quality of results, and resource recovery rate. HC plans to establish a supply chain and expand the sales of solar panel waste at home and abroad through domestic demonstrations. Regions currently under consideration include the United States, Japan, and Australia

■ New eco-friendly business takes off

The establishment of the company’s first recycling JV reflects that its eco-friendly new businesses are in full swing. Eco-friendly business is one of the new business areas that HC has been targeting. In this regard, HC invested KRW 3 billion in Reco Inc. in 2023, a company that connects waste to downstream businesses.

In particular, the solar panel recycling market, which HC is focusing on, is expected to keep growing. The average lifespan of a solar panel is around 20 years, and the demand for recycling is surging as earlier-installed panels gradually reach their end-of-life. According to the Korea Institute of Science and Technology Information (KISTI), the global solar panel waste recycling market is expected to grow from USD 250 million (approx. KRW 290 billion) in 2022 to USD 478 million (approx. KRW 680 billion) in 2026, a CAGR of 20.2%. Especially in the US, Europe, and Japan, the replacement demand for old solar modules is very high, so the market is likely to expand.

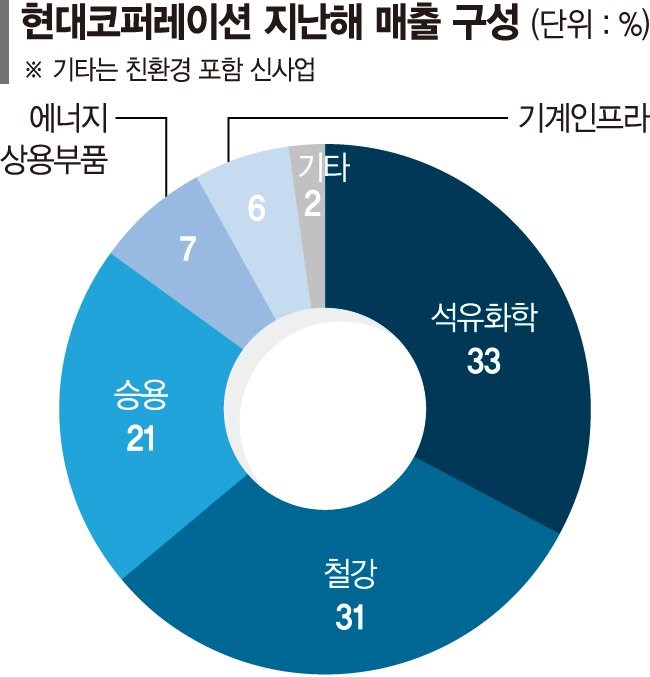

The establishment of the JV may accelerate the diversification of HC’s revenue structure. Currently, more than 90% of its revenue is concentrated in steel and petroleum chemical trading. Hyundai Corporation was formerly the general trading body of Hyundai Group and was incorporated into Hyundai Heavy Industries affiliates in 2010, but it separated from the group in 2015 following an equity spinoff. The securities industry expects HC’s revenue to exceed KRW 7 trillion this year for the first time after the spinoff.

May 14, 2025

Financial News